The Benefits and drawbacks of Various Types of Insurance You Must Know

The Benefits and drawbacks of Various Types of Insurance You Must Know

Blog Article

The Function of Insurance Coverage in Financial Planning: Safeguarding Your Possessions

Importance of Insurance Coverage in Financial Preparation

Insurance policy plays a crucial duty in an individual's financial planning strategy, acting as a secure against unpredicted occasions that can threaten monetary security. By alleviating threats associated with health and wellness concerns, home damages, or obligation insurance claims, insurance coverage provides a monetary safeguard that allows individuals to keep their economic well-being even in damaging scenarios.

The significance of insurance policy prolongs past plain monetary protection; it additionally fosters lasting economic discipline. Normal costs repayments urge individuals to spending plan effectively, guaranteeing that they allot funds for possible dangers. In addition, specific insurance items can function as financial investment lorries, adding to riches build-up gradually.

Additionally, insurance policy can improve a person's capacity to take computed risks in various other areas of monetary planning, such as entrepreneurship or investment in property. Understanding that there is a safeguard in place enables greater confidence in going after opportunities that could or else appear intimidating.

Eventually, the combination of insurance policy right into monetary planning not just protects assets however also helps with a much more resilient economic method. As people navigate life's unpredictabilities, insurance coverage stands as a foundational element, allowing them to develop and maintain wide range over the lengthy term.

Kinds of Insurance Policy to Think About

When examining a detailed economic plan, it is important to consider different sorts of insurance that can resolve various elements of threat monitoring. Each kind serves a special objective and can secure your assets from unexpected occasions.

Health and wellness insurance coverage is important, covering medical expenditures and guarding against high health care costs - insurance. Homeowners insurance coverage shields your residential or commercial property and valuables from damages or burglary, while also giving obligation coverage in case somebody is wounded on your premises. Car insurance is critical for car proprietors, offering security versus damages, burglary, and liability for injuries suffered in crashes

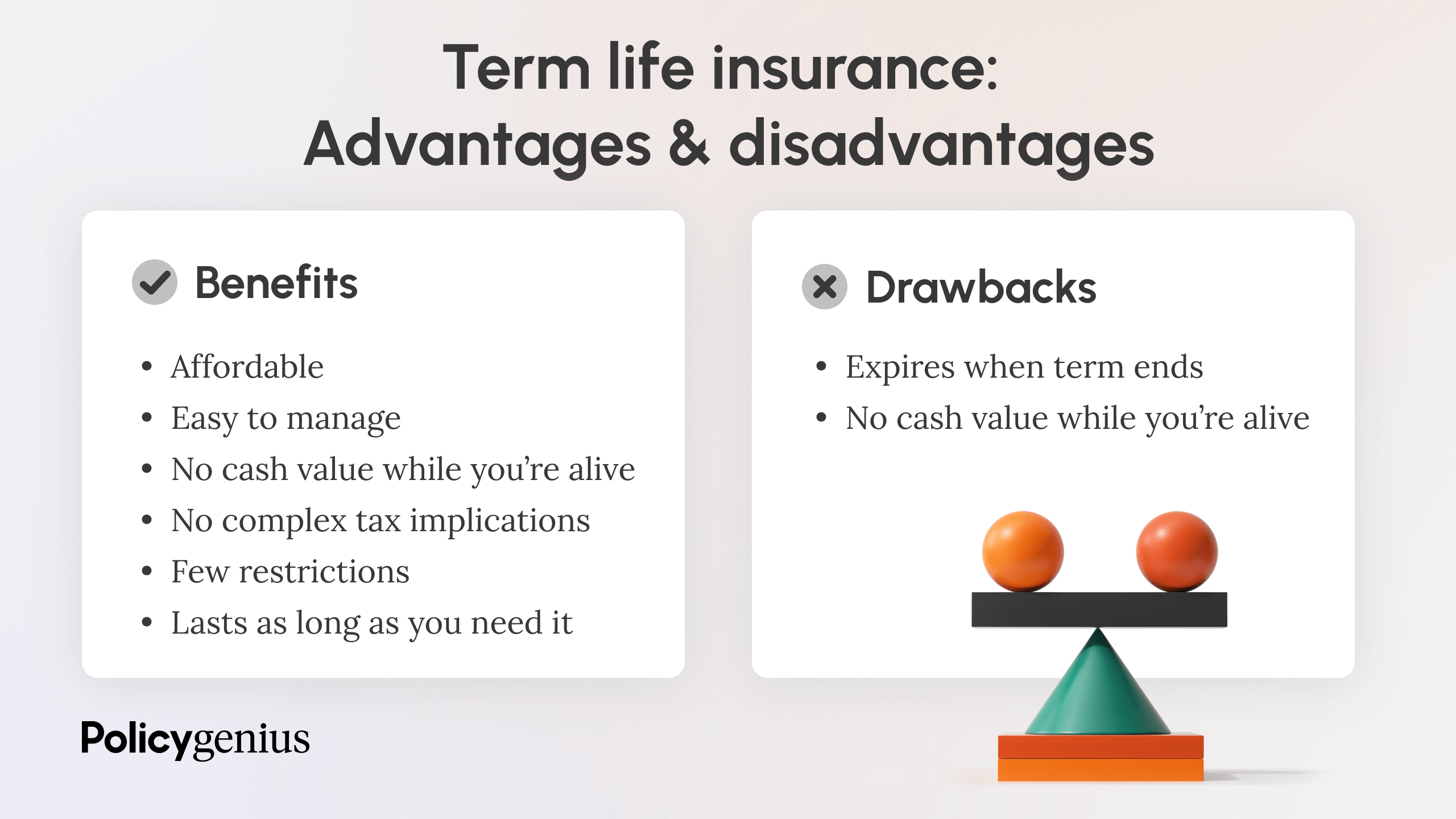

Life insurance policy supplies monetary protection for dependents in case of an unforeseen fatality, guaranteeing their demands are fulfilled. Special needs insurance is just as vital, as it replaces lost income during durations of illness or injury that avoid you from functioning. Additionally, umbrella insurance provides additional obligation insurance coverage beyond common policies, giving an added layer of defense versus substantial cases.

Evaluating Your Insurance Coverage Requirements

Determining the proper degree of insurance policy protection is a critical step in safeguarding your monetary future. To evaluate your insurance coverage needs successfully, you ought to begin by examining your existing properties, obligations, and general financial objectives. This entails taking into consideration aspects such as your income, savings, financial investments, and any kind of financial debts you might have.

Next, identify possible threats that might affect your monetary stability. Examine the likelihood of occasions such as health problem, crashes, or residential or commercial property damages. This threat analysis will certainly assist you establish the kinds and amounts of insurance policy needed, including health and wellness, life, impairment, auto, and property owner's insurance policy.

In addition, consider your dependents and their financial demands in the event of your unfortunate passing - insurance. Life insurance coverage might be crucial for making sure that liked ones can preserve their way of life and satisfy monetary obligations

Integrating Insurance Coverage With Investments

Incorporating insurance policy with investments is a critical approach that improves monetary safety and security and development possibility. Insurance policy items, such as entire life or universal life policies, often have a financial investment element that enables insurance policy holders to build up cash money worth over time.

In addition, integrating life insurance policy with financial investment techniques can supply liquidity for beneficiaries, making sure that funds are readily available to cover instant costs or to spend additionally. This synergy enables a much more thorough danger management strategy, as insurance can secure versus unanticipated scenarios, while investments function in the direction of attaining economic goals.

Moreover, leveraging tax obligation advantages related to particular insurance coverage products can improve overall returns. As an example, the money worth development in irreversible life insurance plans might grow tax-deferred, offering a distinct advantage compared to traditional financial investment cars. Consequently, efficiently integrating insurance with financial investments not only safeguards properties but additionally makes best use of informative post growth chances, leading to a durable monetary strategy tailored to individual requirements and objectives.

Common Insurance Policy Myths Unmasked

Mistaken beliefs regarding insurance policy can significantly impede reliable financial planning. Several people additionally think that all insurance plans are the same; however, coverage can differ extensively based on the copyright and certain terms.

An additional usual misconception is that younger people do not require life insurance policy. However, safeguarding protection at a younger age typically leads to lower costs and can supply necessary assistance for dependents in the future. Additionally, some assume that medical insurance covers all medical expenses, which is not the situation. Lots of policies featured exclusions and deductibles that can bring about substantial out-of-pocket expenses.

Finally, the idea that insurance is just beneficial throughout emergencies neglects its duty in positive financial planning. By including insurance policy into your method, you can safeguard your possessions and enhance your general economic resilience. Dispel these myths to make informed decisions and optimize your monetary planning initiatives.

Final Thought

Finally, insurance policy serves as a basic element of reliable financial planning, offering vital defense against unanticipated threats and adding to asset protection. By understanding numerous kinds of insurance policy and evaluating specific needs, one can accomplish a balanced financial method. The integration of insurance with financial investment possibilities improves wide range accumulation while making sure monetary stability for dependents. Attending to common misunderstandings regarding moved here insurance coverage additionally advertises educated decision-making, inevitably cultivating an extra durable financial future.

In the realm of monetary planning, insurance policy offers as a cornerstone for guarding your possessions and making sure long-lasting stability.The relevance you can try here of insurance policy prolongs past simple economic security; it additionally cultivates lasting monetary technique.Mistaken beliefs regarding insurance coverage can dramatically prevent reliable economic planning.Lastly, the idea that insurance is just helpful during emergencies overlooks its role in positive financial preparation.In conclusion, insurance offers as a basic part of effective monetary preparation, offering essential protection against unanticipated risks and adding to asset protection.

Report this page